-

-

-

Total payment:

-

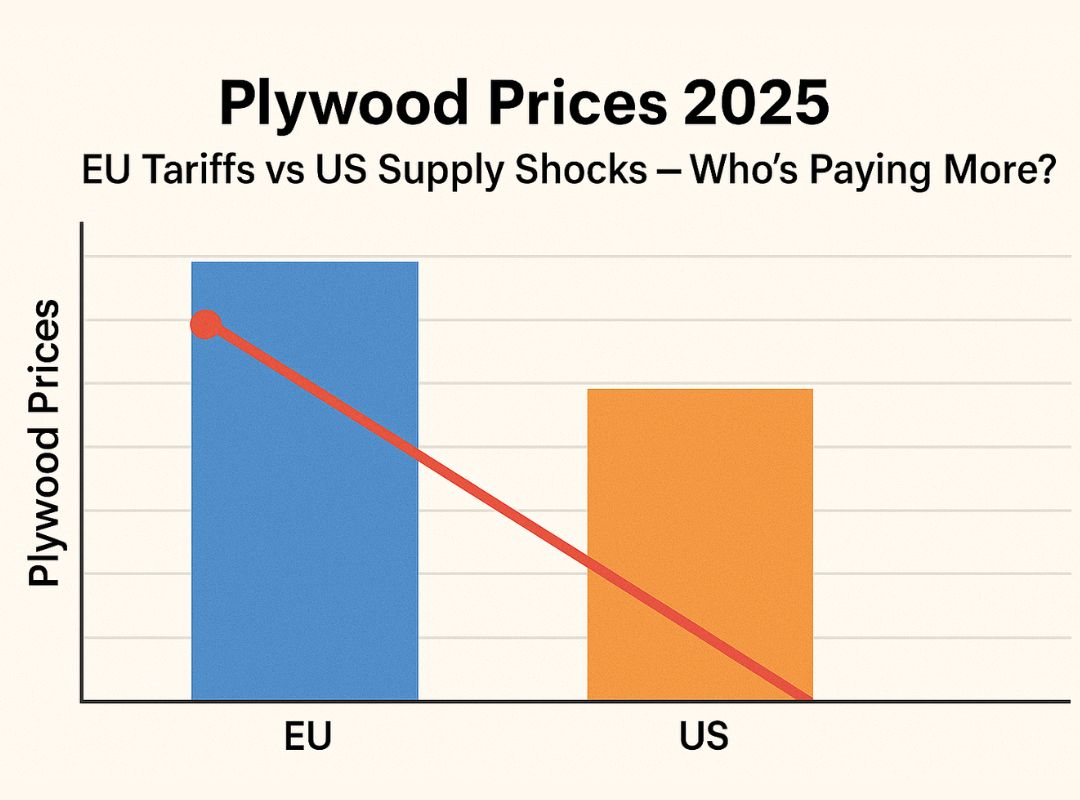

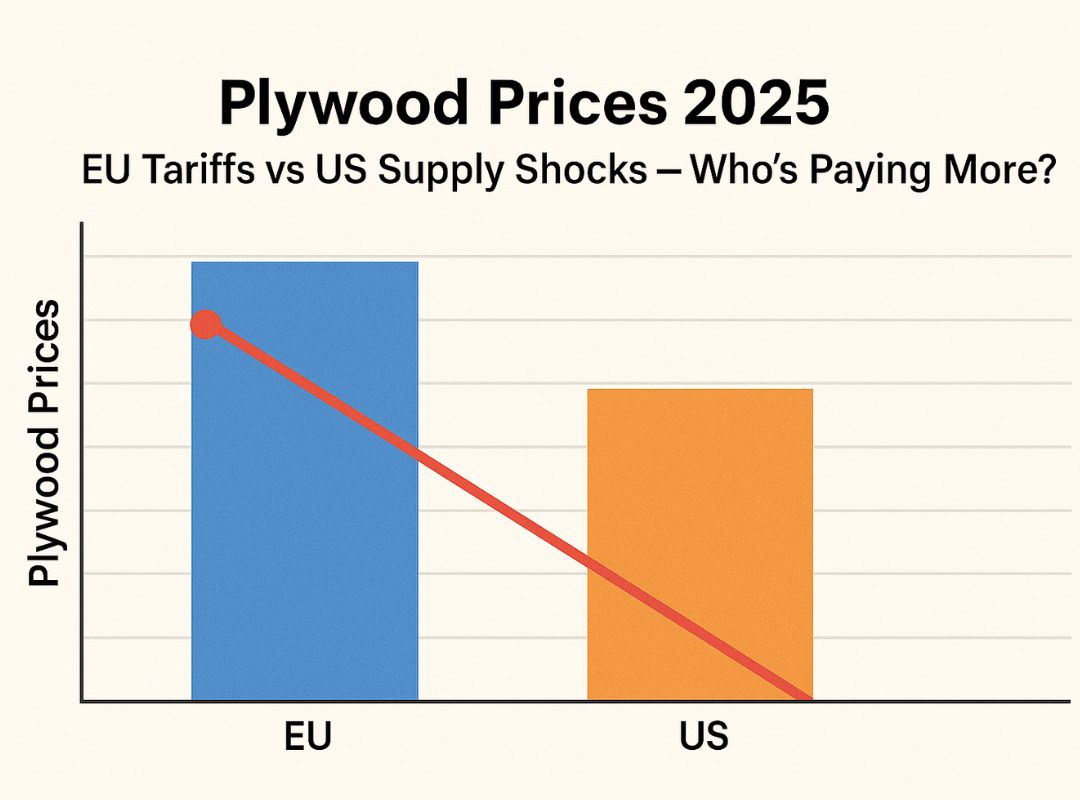

Plywood Prices 2025: EU Tariffs vs US Supply Shocks – Who's Paying More?

Posted by Thanh Uyên at 01/10/2025

A Volatile Global Plywood Market

The global plywood industry enters 2025 under pressure from both regulatory and supply chain challenges. Importers in the European Union face a wave of tariffs and compliance costs tied to carbon rules, while buyers in the United States struggle with recurring supply shocks. These dynamics raise a critical question for the global building sector: who is paying more for plywood in 2025 European or American buyers?

Market analysts note that plywood prices 2025 are already trading at record highs compared with pre-pandemic averages. At the same time, global demand remains strong due to construction booms, infrastructure projects, and sustainability policies that favor wood-based materials. Against this backdrop, both the EU and US markets provide a fascinating study in how geopolitics, climate risks, and green regulations intersect with commodity pricing.

EU’s New Tariff Landscape and Its Impact

European buyers are navigating a layered tariff environment. On one side, the EU has rolled out new carbon border measures and stricter customs checks under the European Union Deforestation Regulation (EUDR). On the other side, member states are reinforcing ESG criteria for imports, demanding proof of sustainable forestry practices through FSC or PEFC certification.

For importers, this means more than paperwork. It means additional costs at every step from due diligence audits to chain-of-custody documentation. The result? EU plywood tariffs and compliance costs in 2025 can add between 8–12% to the landed cost of plywood compared with 2023.

Suppliers from Vietnam, Malaysia, and China are adapting, but the EU’s buyer power ensures that only the most compliant exporters will thrive. For builders and wholesalers inside Europe, this translates to higher shelf prices but also better assurance that materials meet sustainability standards.

US Supply Shocks and Price Surges

Across the Atlantic, the US plywood market suffers from a different problem: volatility. While the EU’s challenges are mostly regulatory, the US is grappling with logistics and supply constraints. In 2025, several supply chain disruptions have driven costs up sharply:

- Ongoing container shortages at West Coast ports.

- Labor strikes in key logistics hubs.

- Extreme weather events, including hurricanes affecting Gulf shipping routes.

- Rising fuel surcharges tied to oil market instability.

Because the US imports a significant share of its plywood from Asia and South America, these shocks ripple quickly through the supply chain. Importers report spot price surges of 15–20% in certain months, especially for specialty grades like film-faced plywood or FSC-certified structural panels.

The phrase “US plywood supply chain disruptions” is now trending in trade publications, highlighting just how fragile the market remains. Unlike the EU, where costs are predictable but elevated, the US faces unpredictable spikes that make long-term planning difficult.

Comparing EU vs US: Who Pays More?

So, who shoulders the heavier burden in 2025? The answer depends on the time horizon.

- European Union buyers: Pay more consistently due to tariffs and compliance costs. Import prices are structurally higher but relatively stable.

- United States buyers: Experience extreme short-term spikes, especially after natural disasters or port strikes. Over a 12-month window, US buyers may pay higher averages than EU peers.

Key cost drivers include:

- Tariffs and EUDR compliance (EU).

- Logistics, fuel, and labor shocks (US).

- Currency exchange volatility (both).

- ESG and green procurement rules (EU).

This comparison shows that plywood prices in the US can exceed EU levels during shock periods, but the EU maintains a higher baseline due to policy costs. For importers, both markets present risks—one regulatory, the other logistical.

Sustainability Pressures and Buyer Strategies

One factor unites both continents: the shift toward sustainable plywood. The EU demands it under EUDR and FSC rules, while the US incentivizes it under green building tax credits and LEED certification pathways.

For buyers, this creates new strategies:

- In the EU, wholesalers are consolidating suppliers, choosing only those with proven carbon-neutral plywood credentials.

- In the US, distributors are hedging against shocks by diversifying import origins—Vietnam, Chile, and Brazil are gaining share.

- Both markets are increasing demand for green building materials, making plywood not just a cost item but a compliance and branding advantage.

Market Outlook for 2025–2026

Looking ahead, analysts predict that plywood price trends will remain elevated. In the EU, tariffs and compliance costs are unlikely to ease, meaning stability at higher levels. In the US, volatility will remain tied to fuel markets and climate events, suggesting more supply shocks in 2026.

At the same time, demand is resilient. Urban housing programs, infrastructure renewal, and the broader sustainability agenda keep plywood at the center of construction planning. By late 2026, the market may see new equilibrium as supply chains diversify and digital compliance tools reduce EUDR costs.

FAQ: Global Plywood Prices 2025

Q1. Why are plywood prices so high in 2025?

Because of EU tariffs, EUDR compliance costs, and US supply chain shocks driving import costs upward.

Q2. Which market is more expensive for plywood EU or US?

The EU has a higher baseline due to tariffs, but the US often pays more during supply disruptions.

Q3. How do sustainability rules affect plywood costs?

Compliance with FSC/EUDR adds costs but also ensures long-term market access.

Q4. Is plywood still cheaper than alternative building materials?

Yes, even with higher costs, plywood remains cost-effective compared with steel or concrete in many applications.

Q5. What’s the plywood price forecast for 2026?

Stable but high in the EU, volatile in the US, with gradual easing as supply chains adapt.

Conclusion

The battle between EU tariffs and US supply shocks shows two different ways plywood buyers are paying more in 2025. European importers face predictable but higher costs, while American buyers live with volatility and spikes. For construction firms, builders, and distributors, the solution lies in trusted suppliers who can provide stability, compliance, and customization.

👉 If your company needs FSC-certified plywood, custom sizes, or sustainable panels for EU and US projects, contact TT Plywood today. Our factory in Vietnam delivers consistent quality, carbon-compliant documentation, and flexible shipping to help you stay competitive.